-

What does

2021 Wis. Act 262 do?

The Act makes tax administration for pass-through entities more efficient for both the department and taxpayers. Specifically, the Act:

- Allows the department to conduct an audit of a pass-through entity entirely at the entity level and may make an assessment and, in certain instances, a refund to a pass-through entity on income and/or credits that are otherwise reportable by its pass-through members (secs. 71.745(1),

(2) and

(3), Wis. Stats.).

- Requires a pass-through entity to designate a pass-through entity representative to act on behalf of the pass-through entity and its members for activities related to the audit (sec.

71.80(26), Wis. Stats.).

- Allows partnerships to request to pay tax at the entity level after an IRS audit (sec.

71.76(2)(b), Wis. Stats.). For more information on making the request, see

Partnerships common questions 3 and 4.

-

What types of entities may be assessed at the entity level under the Act?

Under the Act, the department may make an assessment and/or refund to the following pass-through entities:

- Partnerships

- Tax-option (S) corporations

- Limited liability companies taxed as a partnership or tax-option (S) corporation

- Estates and trusts that are treated as a pass-through entity

Note: Revocable grantor trusts and entities that are disregarded for federal income tax purposes are entities that cannot be assessed at the entity level.

(Sections

71.738(3d), and 71.745(1), (2) and (3))

-

What is the tax rate for assessments at the entity level?

The tax rate at the entity level for income otherwise reportable by

direct pass-through members, as provided in sec.

71.745(2)(a), Wis. Stats., is as follows:

- 7.65% for income otherwise reportable by members that are individuals, estates, and trusts

- 7.9% for income otherwise reportable by all other entities (e.g., corporations and partnerships)

-

How is taxable income computed at the entity level?

The entity is taxed on income otherwise

reportable by its pass-through members as provided in sec. 71.745(2)(a), Wis. Stats.

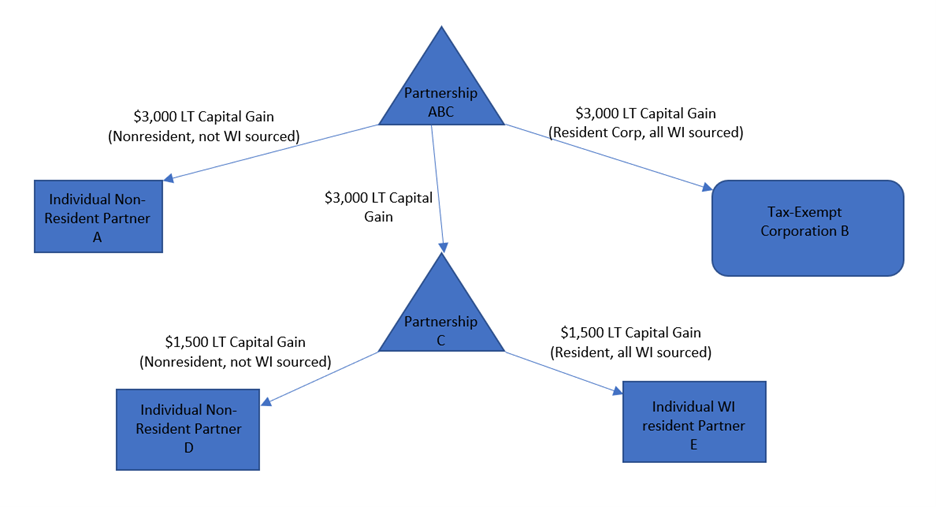

Example:

Facts (during the audit period):

- Partnership ABC has three equal partners:

- Partner A - Individual nonresident

- Partner B - Tax-exempt Corporation B that only does business in Wisconsin

- Partner C - Partnership C that only does business in Wisconsin and has two equal partners:

- Partner D - Individual nonresident

- Partner E – Individual full-year Wisconsin resident

- Partnership ABC under-reported $9,000 of long-term capital gains and is being assessed tax of $356 at the entity level.

| Computation of taxable income at entity level (Partnership ABC) |

| Partnership ABC's under-reported long-term capital gains | $9,000 |

| Less: Income not sourced to Wisconsin | |

| Individual nonresident Partner A's portion from Partnership ABC | ($3,000) |

| Individual nonresident Partner D's portion from Partnership C | ($1,500) |

|

Additional taxable income for Partnership ABC |

$4,500 |

| Computation of tax on taxable income at entity level (Partnership ABC) |

| Portion of long-term capital gains reportable by Corporation B | $3,000 |

| Portion of long-term capital gains reportable by individual resident Partner E | $1,500 |

|

Total taxable income for Partnership ABC |

$4,500 |

| Tax rate based on

DIRECT partners (Corporation B and Partnership C)* | 7.9% |

| Additional tax assessed to Partnership ABC | $356 |

*Although the $1,500 flowing through Partnership C is reportable by individual resident Partner E, Partnership C is the direct partner of Partnership ABC and under sec. 71.745(2)(a), Wis. Stats., the tax rate is 7.9% instead of 7.65%.

-

When computing tax at the entity level, will the department include the proportionate share of pass-through items attributable to tax-exempt pass-through members?

Yes, as provided in sec. 71.745(2)(a), Wis. Stats., pass-through items attributable to tax-exempt pass-through members are included when computing an assessment of additional tax at the entity level.

The pass-through entity may make an election under sec.

71.745(8), Wis. Stats., to reduce their assessment if pass-through members report and pay tax on their proportionate share of the otherwise reportable income within 60 days of the election.

-

If an audit increases a pass-through entity's tax credit and the additional credit exceeds any tax due as a result of the audit, who may claim the additional credit?

Under sec.

71.745(3)(b), Wis. Stats., any excess credit must be claimed by the pass-through members by submitting an amended return for each reviewed year within 1 year from the date the determination of the adjustment becomes final or within 4 years of the unextended due date of the pass-through members' return, whichever is later.

-

How will the assessment at the entity level impact a pass-through member's adjusted basis in their ownership interest of the pass-through entity?

The adjusted basis of the pass-through member's ownership interest is determined as if the assessment was not made at the entity level, as provided in sec.

71.745(4), Wis. Stats.

-

Are there statute of limitations for the department to make an entity-level assessment of tax or an assessment to recover all or part of any tax credit?

Yes, as provided in sec.

71.745(5), Wis. Stats., the statute of limitations for an entity-level assessment are similar to the limitations for other income/franchise return assessments made by the department as provided in sec.

71.77, Wis. Stats.

Note: The statute of limitations under sec. 71.77, Wis. Stats., apply to a pass-through entity without regard to the action or inaction of its pass-through members.

-

Can a pass-through entity appeal an assessment of a pass-through entity made under sec. 71.745, Wis. Stats.?

Yes, the pass-through entity's appointed representative has 60 days after the receipt of the department's determination to file an appeal as provided in sec.

71.745(6)(b), Wis. Stats.

-

Can a pass-through member appeal an assessment of a pass-through entity made under sec. 71.745, Wis. Stats.?

No, only the pass-through entity representative may file an appeal of an assessment as provided in sec.

71.80(26)(b)6., Wis. Stats.

-

Can a pass-through entity elect to preclude an assessment at the entity level?

Yes, under sec.

71.745(9), Wis. Stats., a pass-through entity may elect to preclude the assessment at the entity level if all of the following apply:

- The election is made within 60 days after the department's determination becomes final

- The pass-through entity has 25 or fewer pass-through members for all years under review

- No pass-through member is a pass-through entity (as defined in sec. 71.738(3d), Wis. Stats.) for any year under review

-

How does a qualifying pass-through entity make the election to preclude an assessment at the entity level?

- The entity must make the election in writing within 60 days after the department's determination becomes final and send to:

- The election must include the following:

- A statement signed by an appointed pass-through entity representative or their appointed Power of Attorney that the pass-through entity is electing to preclude the assessment at the entity level as provided under sec. 71.745(9), Wis. Stats.

- A copy of the department's audit notice

- If changing the pass-through entity representative, completed

Form PT-R,

Pass-Through Entity Representative

- Power of Attorney, if applicable

-

If a qualifying pass-through entity makes the election to preclude an assessment at the entity level, how long does the department have to assess the pass-through members?

In general, the department may assess the pass-through members by the latest of the following:

- Within 1 year from the date the election under sec. 71.745(9), Wis. Stats., was made, as provided in sec.

71.77(7)(c), Wis. Stats.

- Within 4 years of the unextended due date of the pass-through members' returns, as provided in sec. 71.77, Wis. Stats.

- Within 4 years of the date the pass-through members filed their original returns, as provided in sec. 71.77, Wis. Stats.

-

If a qualifying pass-through entity makes the election to preclude an assessment at the entity level and the department assesses the pass-through members, do the members have appeal rights?

Yes, the pass-through members have appeal rights. As provided under sec.

71.88, Wis. Stats., any person feeling aggrieved by a notice of additional assessment, refund, adjustment to a credit, or notice of denial of refund may, within 60 days after receipt of the notice, petition the department of revenue for redetermination.

-

If an audit at the entity level results in an increased credit or refund, can a qualifying pass-through entity make an election under sec. 71.745(9), Wis. Stats., to preclude an assessment?

No, sec. 71.745(9), Wis. Stats., is an election to preclude an assessment, meaning an assessment of tax. The department is not issuing an assessment of tax.

Sections 71.745(2)(b) and (3)(b), Wis. Stats., apply and the pass-through members must file amended returns to claim the refund or increased credit from the audit determination.

-

Can a pass-through entity elect to reduce their assessment at the entity level?

Yes, under sec.

71.745(8), Wis. Stats., within 60 days after the department's determination becomes final, the pass-through entity may make an election to reduce their assessment.

The assessment at the entity level may only be reduced for pass-through items where all of the following occur:

- Pass-through member reports on an amended return their proportionate share of the pass-through items within 60 days of the election

- Pass-through member pays any additional tax from reporting their proportionate share of the pass-through items within 60 days of the election

Example:

Facts (during the audit period):

- Partnership ABC has two equal individual Partners A and B.

- Partners A and B are full-year Wisconsin residents.

- Partnership ABC under-reported $100,000 of long-term capital gains and received an assessment of tax at the entity level for $7,650 ($100,000 * 7.65%).

Election:

- Partnership ABC may elect to reduce their assessment of tax resulting from the $100,000 increase in long-term capital gains. Partnership ABC may only reduce their assessment for each member (Partner A and/or B) that files an amended return within 60 days of the election to properly report their proportionate share of long-term capital gains under-reported by the entity and pays any additional tax from reporting their proportionate share of the long-term capital gains.

- If Partners A and B make the adjustment on their individual income tax returns, they may receive the 30% Wisconsin long-term capital gain exclusion. Therefore $70,000 ($100,000 – ($100,000 * 30%) would potentially be taxable. Assuming Partners A and B are in the highest individual Wisconsin tax bracket, the potential combined tax from the Partners' individual income tax returns would be $5,355 ($70,000 * 7.65%).

-

How does a pass-through entity elect to reduce their assessment at the entity level?

- The entity must make the election in writing within 60 days after the department's determination becomes final and send to:

- The election must include the following:

- A statement signed by an appointed pass-through entity representative or their appointed Power of Attorney that the pass-through entity is electing to reduce the audit assessment at the entity level as provided under sec. 71.745(8), Wis. Stats.

- A statement including the following for each pass-through member intending to report and pay within 60 days after the election:

- Full name

- Address

- Social Security Number or Federal Employer Identification Number

- Proportionate share of each pass-through item adjusted in the audit

- A copy of the department's audit notice

- If changing the pass-through entity representative, completed Form PT-R,

Pass-Through Entity Representative

- Power of Attorney, if applicable

-

What is a pass-through entity representative?

A pass-through entity representative is defined in sec.

71.80(26)(a), Wis. Stats. Each pass-through entity shall designate, in the manner prescribed by the department, a pass-through member or other person with substantial presence in the United States as the representative of the pass-through entity.

The pass-through entity representative may be an entity. However, the entity must provide an individual contact with substantial presence in the United States.

Note: The department will treat the most recently appointed pass-through entity representative as the representative under sec.

71.80(26), Wis. Stats.

-

What does substantial presence in the United States mean?

A person has substantial presence in the United States if:

- The person makes themselves available to meet in person in the United States at a reasonable time and place; and

- The person has a United States taxpayer identification number, a street address that is in the United States and a telephone number with a United States area code.

-

What are the pass-through entity representative's powers and duties?

A pass-through entity representative has the following powers and duties as provided in secs. 71.80(26)(b) and

(c), Wis. Stats.:

- Act as sole authority on behalf of the pass-through entity and its pass-through members with respect to a determination under sec. 71.745, Wis. Stats. Including making the election to reduce an entity-level audit assessment under sec. 71.745(8), Wis. Stats., or the election to preclude an entity-level audit assessment under sec. 71.745(9), Wis. Stats.

- Provide the department sufficient information to identify each pass-through member and the capital, profit, and loss interest of each pass-through member.

- Enter into extension agreements on behalf of the pass-through entity under sec. 71.77(5), Wis. Stats.

- Receive notices of pass-through entity adjustments.

- Notify all pass-through members of their share of corrections and adjustments made to pass-through items within 60 days after a determination under sec. 71.745, Wis. Stats., becomes final or after receipt of notice of approval under sec.

71.76(2)(b), Wis. Stats.

- File appeals of notices of pass-through entity adjustments.

- Enter into settlement agreements and bind pass-through members to adjustments relating to pass-through items.

- Delegate the powers and duties of the pass-through representative to an authorized agent of the pass-through entity (e.g., Power of Attorney).

-

Is a pass-through entity representative required if the pass-through entity already has an authorized Power of Attorney on file with the department?

Yes, for pass-through entity audit determinations made under sec. 71.745, Wis. Stats., a pass-through entity representative has specific authorities under sec. 71.80(26), Wis. Stats., that are not otherwise authorized for a Power of Attorney. The following chart provides a comparison of authority with respect to a pass-through entity audit determination:

| Authority for Pass-Through Entity Audit Determination | Power of Attorney | Pass-through Entity Representative |

|---|

| Enter into an agreement to extend the limitation period to make an audit determination | No | Yes |

| Enter into settlement agreements and bind pass-through members to adjustments in audit determination | No | Yes |

| File an appeal of the audit determination | No | Yes |

| Elect to reduce an audit assessment under sec. 71.745(8), Wis. Stats. | No | Yes |

| Elect to have an audit assessment assessed to the pass-through members under sec. 71.745(9), Wis. Stats. | No | Yes |

| Receive limited information about pass-through members from the department as provided under sec.

71.78(11)(b), Wis. Stats. (i.e., only information necessary to explain or determine the proper amount of the pass-through entity audit determination) | Yes | Yes |

| Receive notice of a pass-through entity audit determination | Yes | Yes |

| Notify pass-through members of corrections and adjustments made to pass-through items | Yes | Yes |

| Inspect or discuss confidential tax information related to a determination under sec. 71.745, Wis. Stats. | Yes | Yes |

Note: A Power of Attorney may be appointed as a pass-through entity representative under sec. 71.80(26)(a), Wis. Stats., or a pass-through entity representative may designate a Power of Attorney to act in the same capacity as a pass-through entity representative under sec. 71.80(26)(c), Wis. Stats.

-

How does a pass-through entity designate a pass-through entity representative?

- For tax years beginning after December 31, 2021, a pass-through entity representative may be designated on the following Forms:

- Form 2,

Wisconsin Fiduciary Income Tax for Estates and Trusts

- Form 3,

Wisconsin Partnership Return

- Form 5S,

Wisconsin Tax-Option (S) Corporation Franchise or Income Tax Return

- For tax years beginning prior to January 1, 2022, or to request a change of a pass-through entity representative, the pass-through entity may at any time provide a written statement to the department appointing or revoking a pass-through entity representative. The statement must be signed by an authorized agent of the pass-through entity and include the same information as requested on Form PT-R,

Pass-Through Entity Representative. The department recommends using the Wisconsin Form PT-R to appoint or revoke a pass-through entity representative.

Send written statements or Form PT-R to:

Note: The department will treat the most recently appointed pass-through entity representative as the representative under sec. 71.80(26), Wis. Stats.

-

What happens if the pass-through entity has not designated a pass-through entity representative?

The department will send written notification for the pass-through entity to appoint a representative.

If, within 60 days following receipt of the written request from the department, the pass-through entity fails to appoint a representative, the department may designate a representative and notify the pass-through entity, or the beneficiaries in the case of a closed estate or trust, in writing of the designation.

As provided in sec. 71.80(26)(a), Wis. Stats.

-

Can the pass-through entity appoint a different representative even if the department has made the designation?

Yes, the pass-through entity may at any time provide a written statement to the department appointing or revoking a pass-through entity representative. The statement must be signed by an authorized agent of the pass-through entity and include the same information as requested on Form PT-R,

Pass-Through Entity Representative. The department recommends using the Wisconsin Form PT-R to appoint or revoke a pass-through entity representative.

Send written statements or Form PT-R to:

-

Can the Wisconsin pass-through entity representative be different than the federal representative?

Yes.