-

What portion of the Research Credit is refundable?

The credit changed from 100% non-refundable to 10% refundable for tax years beginning after December 31, 2017, and increased to 15% for tax years beginning on or after January 1, 2021. For tax years beginning after December 31, 2023, the refundable portion is 25%.

-

Who may claim the refundable portion of the credit?

An individual, a partner of a partnership, a shareholder of a tax-option (S) corporation, a member of a limited liability company, or corporation may claim the credit.

-

Who may NOT claim the refundable portion of the credit?

Partnerships, limited liability companies, and tax-option (S) corporations may not claim the credit, but the eligibility and amount of credit are based on their payment of qualified research expenses in Wisconsin. A partnership, limited liability company, or tax-option (S) corporation computes the amount of credit that its partners, members, or shareholders may claim and provides that information to them. Partners, members of limited liability companies, and shareholders of tax-option corporations claim the credit in proportion to their ownership interests.

-

Which research credits are eligible for the refundable portion of the credit?

The following research credits are eligible for the refundable portion of the credit:

- Research credit for qualified activities

- Research credit for activities related to internal combustion engines

- Research credit for activities related to certain energy efficient products

-

What schedule is used to compute the refundable portion of the credit?

Schedule R is used to compute the refundable portion of the research credit. Line 17 computes the maximum refundable portion and line 19 determines the remaining credit available after offsetting the current year's tax liability. Line 20 determines the refundable portion based on the lesser of lines 17 and 19.

-

How is the refundable portion of the credit computed?

The maximum refundable portion of the credit is computed by multiplying the current year's research credit by 25%. The refundable portion is the lesser of 1) the current year research credit remaining after subtracting the amount of current year credit used to offset tax, or 2) 25% of the current year research credit.

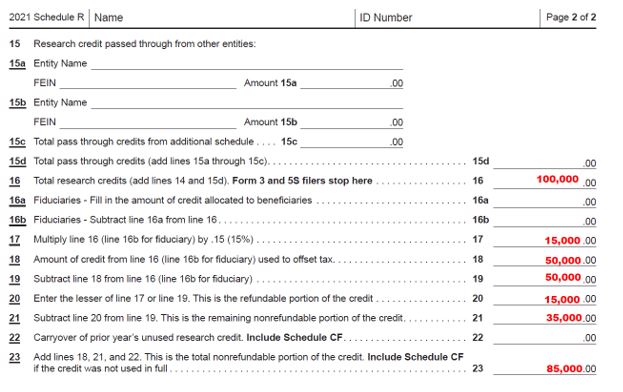

Example 1:

- Taxpayer computes a current year research credit of $100,000.

- Taxpayer uses $50,000 of the current year research credit to offset the current year tax liability.

- The taxpayer computes the full 25% refundable portion of the credit as shown below:

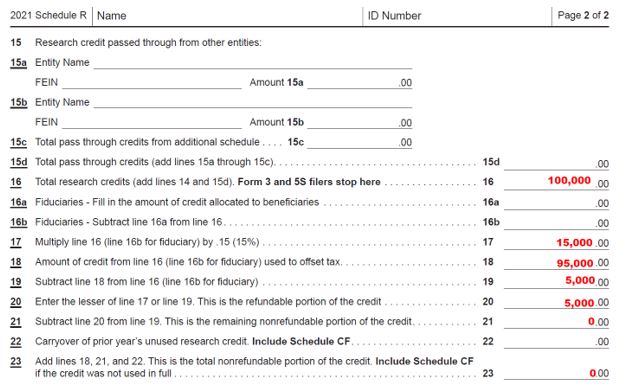

Example 2:

- Taxpayer computes a current year research credit of $100,000.

- Taxpayer uses $95,000 of the current year research credit to offset tax.

- The taxpayer computes the refundable portion of the credit at less than 25% maximum as shown below:

-

What happens to the portion of the research credit that is not refundable?

The nonrefundable portion of the research credit may be carried forward for up to 15 years but may not be used to compute the refundable portion of the credit in future taxable years.

-

Does a prior year research credit carryforward effect the refundable portion of the credit?

No. Prior year research credit carryovers have no effect on the computation of the refundable portion of the credit. Under sections 71.07(4k)(e)2., 71.28(4)(k), and 71.47(4)(k), Wis. Stats., if an allowable amount of current year credit claimed under paragraphs (ad)4., 5., or 6., exceeds the tax due, up to 25% of the credit may be refunded.

-

Can the current years unused research credit become refundable in future periods?

No. Sections

71.07(4k)(e)2.,

71.28(4)(k), and

71.47(4)(k), Wis. Stats., provide that if the allowable amount of current year credit exceeds the tax due, up to 25% of the credit may be refunded. Prior year research credit carryovers are not used to compute the current year research credit.

-

Can the refundable portion of the credit be shared with other members of the same combined group?

No. Section Tax 2.61(10)(b), Wis. Adm. Code, provides that refundable credits computed by a combined group member shall be claimed on the combined return and refunded to the designated agent.

-

If a member of a combined group wants to share their nonrefundable portion of the research credit, are they required to use the research credit to offset their own tax before sharing?

Yes, only after using the credit or credit carryforward to offset its own current year tax liability may the corporation use that credit or credit carryforward to offset the tax liability of all other combined group members on a proportionate basis, to the extent such tax liability is attributable to the unitary business.

-

Can a prior year research credit carryforward offset current year's tax prior to claiming the maximum 25% refundable portion of the research credit?

Yes, a credit carryforward is a nonrefundable credit and therefore offsets a current year tax liability prior to the current year 25% refundable credit.