-

Zoning requires a minimum of five acres to split off as a residential parcel. Can I use that acreage requirement as the land "necessary for the location and convenience" of the agricultural improvements, when the agricultural buildings include a residence?

No. Even though the minimum residential parcel size may be five acres, if all or part of the land is primarily devoted to a qualifying agricultural use under administrative rule (sec. Tax

18, Wis. Adm. Code), the qualifying acreage is classified as agricultural. Actual acreage devoted to the farm set (collection of agricultural buildings) including the residence should be determined independently for each parcel. Acreage use, not zoning, is the determining factor.

-

A 40-acre parcel classified as agricultural (class 4) in 2024 is sold during that year. The property was re-zoned residential, and a subdivision approval was granted before January 1, 2025. As of June 2025, the parcel was covered with last year's crop stubble. Do the earlier activities indicating a future use change and the lack of use in agricultural meet the rule's criteria of "incompatible with agricultural use?"

This parcel does not become incompatible with agricultural use based solely on the legal changes (rezoning and subdivision approval). Even the presence of survey stakes may not impact a farmer from producing and harvesting an agricultural crop. Since the land was in an agricultural use during the production season before the January 1, 2025 assessment date, its classification in the January 1, 2025 assessment roll is agricultural.

-

Can a municipality pass an ordinance against using land for agricultural purposes, which in effect would disallow agricultural classification of that land?

A municipality may pass this type of ordinance. The legality of such an ordinance, and administration of it, is on a case-by-case basis. Land must be classified as agricultural if it was devoted primarily to a qualifying agricultural use under administrative rule (sec. Tax

18, Wis. Adm. Code), during the prior production season and was compatible with agricultural use on January 1 of the current assessment year. Even if in violation of ordinance, easement, or contract, the agricultural classification applies until the land is no longer devoted primarily to a qualifying agricultural use.

-

Should land actively used for agricultural purposes, in violation of a local ordinance prohibiting agricultural use, still be classified as agricultural?

Yes. Since state law supersedes local ordinances, this land is classified as agricultural, because it meets the definition of agricultural under sec. Tax

18, Wis. Adm. Code. Enforcement of the ordinance is a municipal decision. Once the land is no longer used for agricultural purposes, either through enforcement of the ordinance or the landowner's choice, the classification must be changed from agricultural to another classification. Land must be classified as agricultural if it was devoted primarily to a qualifying agricultural use under administrative rule (sec.

Tax 18, Wis. Adm. Code), during the prior production season and was compatible with agricultural use on January 1 of the current assessment year. Even if in violation of ordinance, easement, or contract for the current assessment year, the agricultural classification applies until the land is no longer devoted primarily to a qualifying agricultural use.

-

Is land enrolled in the Conservation Reserve Program (CRP) considered an agricultural use?

Administrative rule (sec.

Tax 18, Wis. Adm. Code), lists enrollment in CRP as an agricultural use. However, land removed from the CRP program may now be incompatible with agricultural use (e.g., wooded) and may need to be reclassified and valued at its appropriate assessed value according to state law. For more information on programs qualifying for agricultural classification, see the

Tax 18 Publication.

-

Can land enrolled in other programs be considered an agricultural use?

Lands in other programs may qualify, see the

Tax 18 Publication.

Note: If land is devoted primarily to an agricultural use under administrative rule (sec. Tax

18.05(1)(a),(b), or

(c), Wis. Adm. Code), in the prior production season and is not in a use incompatible with agriculture on the assessment date, it may qualify for agricultural classification and agricultural classification. In essence, the land may qualify for use-value assessment, based on how it was used, NOT because of the program it is in.

-

When is forest land properly classified as pasture land?

Pastured woods devoted primarily to agricultural use (keeping, grazing, or feeding livestock) qualifies for agricultural classification. Active grazing keeps the undergrowth in check. A few paths through the wooded area are not convincing evidence that the wooded area is pastured. The land must be pastured daily or on a reasonably periodic basis. Fencing must adequately prevent animals from straying. Land with non-existent or severely limited foliage or plant growth is not considered pasture. The best source for definitions of all land classes is the

Wisconsin Property Assessment Manual. Pasture is defined in Chapter 14 and forest is defined in Chapter 15. Information can also be found in the

Agricultural Assessment Guide for Wisconsin Property Owners.

-

Are small parcels of land eligible for agricultural classification?

Yes. Size is not relevant when determining if a parcel of land is classified as agricultural. A five-acre apple orchard or a small-acreage vegetable field can be considered devoted primarily to agricultural use. Whether small or large, the land must be devoted primarily to an agricultural use as defined in administrative rule (sec.

Tax 18.05(1), Wis. Adm. Code), during the production season before the assessment date of January 1 and not in a use incompatible with agricultural use on January 1 to be eligible for an agricultural classification.

When classifying land based on its use, the assessor should not consider the size of typical operating farms. The assessor must classify the land according to the acres used for agricultural purposes, considering the use of each parcel individually.

-

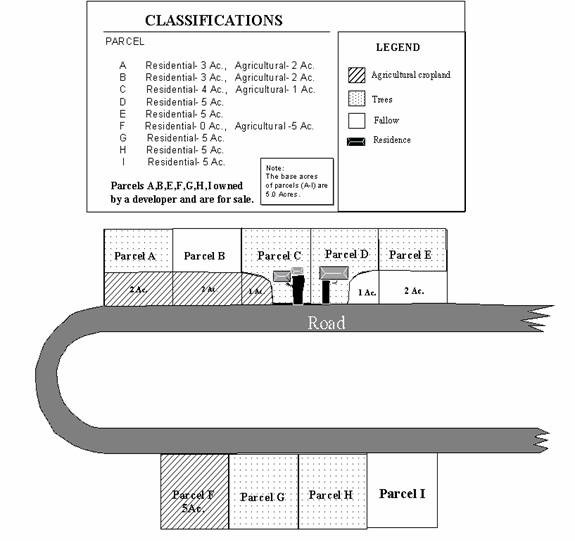

What is the proper classification for each of the following parcels?

Example: A farmer has a 120-acre farm operation with qualifying agricultural uses under administrative rule (sec. Tax

18, Wis. Adm. Code). A portion of the operation is experiencing a change in use as illustrated in the diagram below. The farmland is being developed into a residential subdivision with several parcels approximately five acres each. The subdivision is in an area showing residential growth. Utilities are available at the parcel line. Parcel sizes range from one to 10 acres. Some of the parcels have qualifying agricultural uses; others have a mixture of qualifying agricultural uses and woods; others have a mixture of land uses.

Parcel A — is a five-acre parcel, partially wooded, with two acres devoted to crop production. The crop was harvested last fall.

- Parcel is classified as part agricultural (the two acres) and part residential

- Agricultural land is part of the farm operation and was used for a qualifying activity under sec. Tax

18, Wis. Adm. Code, in the previous growing year

- Wooded area is part of the small parcel the owner could build on and is in an area of typical five-acre parcel sizes

Parcel B — is located next to parcel A. It has a two-acre field, as an extension of the field in parcel A. The balance of the three acres is fallow tillable.

- Parcel is classified as part agricultural and part residential

- Agricultural land is part of the farm operation and produces value from the land for the landowner

- Fallow land is part of a residential subdivision where the residential infrastructure is in place and the construction of a residence is imminent

- Advertised for sale as residential and is a typical residential parcel size for the community

Parcel C — is located next to parcel B. It has a residence on part of it with about three acres of trees and one acre of agricultural land (part of the same fields and operation as above).

- Parcel is classified as one acre of agricultural

- Balance is classified as residential

- Land around the residence is used in support of the residential nature

- Trees are also in support of the residential use of the parcel

Parcel D — is mostly wooded, but has one acre of fallow ground and a residence.

- Parcel is classified as Residential as there is no agricultural activity

- Fallow land is part of a residential subdivision where the residential infrastructure is in place and the construction of a residence is imminent

- Advertised for sale as residential and is a typical residential parcel size for the community

Parcel E — is adjacent to parcel D, and has a two-acre fallow field with three acres of wooded land.

- Entire parcel is classified as residential

- No qualifying agricultural activity on the parcel

- Part of a residential subdivision where the residential infrastructure is in place and the construction of a residence is imminent

- Advertised for sale as residential and is a typical residential parcel size for the community

Parcel F — is a five-acre parcel; all agricultural land, farmed last year as part of the farm operation; with no building on the parcel as of the assessment date.

- Classified as agricultural, with use-value assessment

- Primary use is a qualifying crop activity and is not in a use incompatible with agricultural use

Parcel G — is a five-acre parcel adjacent to the above entirely agricultural parcel. It is covered with trees.

- Classified as residential

- Part of a residential subdivision where the residential infrastructure is in place and the construction of a residence is imminent

- Advertised for sale as residential and is a typical residential parcel size for the community

Parcel H — is an all-wooded parcel next to parcel G, and adjacent to parcel I, which is fallow.

- Classified as residential

- Part of a residential subdivision

- Construction of a residence is imminent

- Advertised for sale as residential and is a typical residential parcel size for the community

Parcel I — is a fallow parcel, adjacent to the wooded parcel above.

- Classified as residential

- Part of a residential subdivision where the residential infrastructure is in place and the construction of a residence is imminent

- Advertised for sale as residential and is a typical residential parcel size for the community

-

How are site acres of other (class 7) determined? How does a property owner appeal the assessor's determination of the size of the farm site?

Per state law, the land necessary for the location and convenience of the farm home and farm buildings is classified as other (class 7). To determine the amount of land in this class, the assessor should use aerial photographs and scale the area used for the location and convenience of the buildings.

If the property owner has a different opinion of the site acres, the owner should bring credible supporting evidence to the assessor and, if needed, to the Open Book or Board of Review. Examples of evidence include: certified survey map, newer air photo, other information showing the necessary land area.

For more information on how to determine home site acreage, review Chapter 14 of the

Wisconsin Property Assessment Manual.

-

How is the classification of other (class 7) improvements determined? What factors are used to make this determination? Is it proper to classify a set of improvements by listing the agricultural outbuildings as other (class 7) and the residence as residential (class 1)?

Generally, improvements should be classified as other (class 7) when the predominant use of the buildings is agricultural. Factors including the current use, potential use, number and significance of outbuildings, parcel size, and the nature of the agricultural buildings in support of the farm, aid the assessor in making this determination. Assessors should have a single class for each set of buildings based on the predominant use of the entire set rather than splitting classifications of building sets. However, state law (sec.

70.32(2)(c)1m, Wis. Stats.), allows the assessor to classify some typical residential building sets as "other" if the residence is used for the farm operator's spouse, children, parents, or grandparents. These residences must be located on land that is part of the farm operator's farm operation.

-

How should the site acres for other (class 7) lands be valued? Should they be valued as one- or two-acre parcels? Should the fact that the site is part of a larger parcel be considered?

Lands necessary for the location and convenience of buildings should be valued at their contributory market value adjusted to the appropriate assessment level of all other property in the municipality. Each improved agricultural site must be analyzed relative to the number of acres needed for the location and convenience of the buildings. Some parcels may, due to the number and size of the improvements, need to have larger site sizes than others. Assessors are cautioned not to use the same size for all improved parcels in their municipality. When valuing the site, it is important assessors value the site considering its contributory market value to the entire parcel.

-

How should an assessor classify tillable land where the Wisconsin Department of Natural Resources purchased an easement that does not allow tilling or grazing the land?

If the land is enrolled in a qualifying government program, under administrative rule (sec. Tax

18.05(1), Wis. Adm. Code), the land should be classified as agricultural, and placed in the sub-class of agricultural it would be in if it were farmed.

For lands that do not qualify, the classification must be changed to another class — most likely undeveloped land (class 5), agricultural forest (class 5m), or productive forest (class 6). The land should then be valued at market value, considering the effect on value (if any) the easement has on the land. The market value is then adjusted to 50% of full value for undeveloped land and agricultural forest. Finally, all classes of land are adjusted to the average level of assessment for the community. See

Tax 18 Publication.

The land must be classified as agricultural if land was devoted primarily to a qualifying agricultural use under sec. Tax

18.05(1), Wis. Adm. Code, during the prior production season and was compatible with agricultural use on January 1 of the current assessment year Even if in violation of ordinance, easement, or contract, for the current assessment year. The agricultural classification applies until the land is no longer devoted primarily to a qualifying agricultural use.

-

How is a 20-acre parcel with a one-acre building site and 19 acres of grazing area for a horse classified? Are the 19 acres considered an agricultural use?

Keeping a horse for personal use or boarding horses does not meet the definition of agricultural use under administrative rule (sec. Tax

18.05, Wis. Adm. Code). Some land uses may seem agricultural on the surface, but fail to meet the definitions in sec. Tax

18.05, Wis. Adm. Code. By administrative rule, training race horses, operating riding stables, rental of saddle horses, and operating a horse race track are considered Arts, Entertaining, and Recreation industries under the North American Industry Classification System (NAICS) and do not qualify for agricultural classification.

Raising horses under NAICS Industry 112920 is considered an agricultural use. Establishments providing foal rearing, health maintenance, controlled feeding and harvesting, for the eventual sale of the animals are considered an agricultural use.

Renting land to a horse owner might appear as pasture, but if the land is not being used for an agricultural use, as defined in the previous paragraphs, the land is ineligible for agricultural classification

-

A person bought a parcel of agricultural and forest land during 2024 for substantially more than the 2024 assessment. The municipality was revalued in 2025. For 2025, the assessor assessed the agricultural land using the published 2025 use values. The remaining forest land was assessed using the 2024 selling price minus the 2025 use value of the agricultural lands. Was this correct?

No. The sale should be analyzed using the contributory market value of all the components included in the sale. Once the contributory market value of each component was identified, the non-agricultural components should be assessed according to the correct statutory provisions. The tillable land and pasture land were properly assessed using the 2025 use values. The assessor should not take the selling price minus the use value to determine the non-agricultural property assessment.

-

Is there a conversion charge for converting agricultural land to another use?

Yes. Property no longer used for agricultural purposes that benefited from lower property taxes as a result of agricultural classification, is subject to a conversion charge if the land use is converted to a residential, commercial or manufacturing use.

However, when agricultural land is converted to another use and becomes exempt, the assessor must consider what the classification would be if it were not exempt, to determine if a conversion fee is applicable. A conversion charge does not apply if the land meets the definition of and is classified as undeveloped land, agricultural forest, productive forest, or "other" (ex: the agricultural home site).

Assessor makes the determination on the following year's assessment roll. The conversion charge varies by the number of acres converted. The more acres converted, the lower the charge amount per acre. For more information, review the

common questions for agricultural land conversion charge.

-

Can Board of Review (BOR) members view the property in person to determine whether a piece of property is used for pasture, rather than woods?

No. The BOR may only act upon sworn evidence. The BOR may determine a classification change (and subsequent value change) is appropriate if there is sworn testimony before the BOR supporting such action. Under state law (sec.

70.47, Wis. Stats.), the BOR may act only on evidence produced under oath.

-

Is maple sap gathering considered an agricultural activity, and if so, how should this type of land be assessed?

By administrative rule, maple sap gathering is a qualifying agricultural use since the NAICS includes maple sap gathering as a crop production activity. Land devoted primarily to maple sap gathering in an area of maple trees tapped during the production season before the assessment date of January 1 and not in a use incompatible with agricultural use on January 1, is classified as agricultural and assessed at its use value.

The agricultural classification law does not have a minimum acreage size. Small acreages can qualify for agricultural classification if they are primarily used for agricultural purposes.

Qualifying acres must be tapped in the previous production season and be considered primarily engaged in maple sap gathering. Producers in the business generally follow industry standards for tapping trees. Producers following industry standards decide to tap maple trees within a mixed species woods when the density of maple trees is enough to make the use economically feasible. It is estimated that in a mixed-species stand of woods, a low to average quality tract has 20 tapped trees per acre whereas 30-40 tapped trees per acre is considered a high-quality stand in Wisconsin. Acres within a forest sufficiently tapped based on the industry standards qualify for agricultural classification, whereas areas within a forest with no tapping or minimal tapping do not qualify.

This effectively disqualifies an activity that is occasionally and minimally tapping large areas and claiming the entire acreage qualifies for agricultural purposes.

-

Are licensed game farms considered an agricultural use?

The NAICS classifies game farms, fishing preserves, hunting preserves, and game propagation as Fishing, Hunting and Trapping industries, which are not agricultural uses. Land used for these purposes is classified based on its predominate use (possibly commercial or forestry) and valued as a market value class. However, establishments engaged in deer production that provide fawn rearing, health maintenance, controlled feeding and harvesting for the eventual sale of the animals are considered an agricultural use. The fenced land devoted primarily to deer production is classified as Agricultural and categorized as grade 1, 2, 3 or pasture according to the soil type.

-

Is aquaculture an agricultural use?

Land devoted primarily to animal aquaculture qualifies as an agricultural use under administrative rule (sec. Tax

18.05(1)(b), Wis. Adm. Code), Animal Production. Animal aquaculture establishments use intervention to control and enhance production through methods including health maintenance, controlled feeding, and protection from predators. Aquaculture fishponds provide an area for the keeping and feeding of fish being raised for market. Fishponds classified as agricultural should be categorized as pasture.

Not all aquaculture operations fit the definitions of agricultural land. Outdoor concrete raceways and indoor hatchery facilities do not meet the definition in state law (sec.

70.32(2)(c)(1), Wis. Stats.), that agricultural land is "land exclusive of buildings and improvements and the land necessary for their location and convenience, that is devoted primarily to agricultural use as defined by rule." Additionally, fishing preserves, recreational uses, and personal uses do not qualify as an agricultural use.

-

Is cranberry production an agricultural use?

Yes. Land under a cranberry bed is considered land devoted primarily to an agricultural use. Cranberry land classified as agricultural should be categorized as third-grade tillable and adjusted to the local level of assessment.

Note: Land underneath earthen features (ex: dams, dikes, ditches, inlets, outlets) surrounding the beds are classified as other (class 7), and assessed at the third-grade tillable value and adjusted to the local level of assessment. The earthen features are valued according to a cost less depreciation methodology.

-

Is nursery stock production an agricultural use?

Yes. NAICS Industry Classification 111421 defines growing nursery products, nursery stock, shrubbery, bulbs, fruit stock, and sod as crop production, an agricultural use. Also, under state law, growing short rotation woody trees with a growth and harvest cycle of 10 years or less for pulp or biomass stock is now included as an agricultural use. The occasional harvest of a few trees on one's property does not constitute a commitment primarily to agricultural use.

-

How are agricultural use-values determined?

DOR annually publishes

use-values for tillable grades 1, 2 and 3, and pasture lands. DOR determines the use-values by using a multipart formula based on the income approach to value. The income is derived from crop-share agreements (which account for certain farming expenses) and corn harvest data. The values are determined for each municipality in every county. Annual changes to use-values are limited to the annual statewide change in Equalized Values, less the value of agricultural land and new construction. See the

Wisconsin Property Assessment Manual, Chapter 14, Appendix B, for additional information.

-

How does an assessor know if acreage is enrolled in a program eligible for agricultural classification if the land is not currently being used for agriculture?

The assessor should call, email or send Agricultural Classification Conservation Program Information Request forms (PR-324) to owners of questionable parcels if the owner did not previously provide the information.

-

How should the phrase "production season" as specified in administrative rule (sec.

Tax 18.06(1), Wis. Adm. Code), be applied in determining eligibility for agricultural use valuation?

Qualifying agricultural uses include tilled land devoted to crop production, pastured land devoted to livestock production, and specified conservation programs. During the use review, consider the following when evaluating the "production season" (sec. Tax

18.06(1), Wis. Adm. Code).

The phrase "production season" is generally associated with agricultural activity commencing in the spring and concluding in the fall. This standard applies to the majority of agricultural uses in Wisconsin. The inclusion of this phrase provides assessors with a standard when determining if the land is "devoted primarily to an agricultural use." Since there are crop production cycles and livestock production practices that may fall outside this standard parameter, it is important that the property owner discuss the endeavor with the municipal assessor. However, these situations are infrequent since the land is also in agricultural use during the standard agricultural production season. When land is an agricultural use for a minimal amount of time that is outside the standard production season, the assessor must evaluate the circumstances of each situation to determine the land's primary use.